by Casey Harper

The Bureau of Labor Statistics released data Tuesday showing a sharp increase in consumer prices, especially gasoline, as many Americans struggle to make ends meet.

March saw a 0.6% increase in consumer prices, the largest spike in nearly a decade. That increase can be attributed in large part to a rise in inflation.

However, increased inflation, a rise in demand for crude oil, and the Biden administration’s proposed new taxes and regulatory measures could send gas and energy prices soaring even higher in the months to come, critics contend.

In March, gasoline prices rose 9.1% and natural gas rose 2.5%, contributing to an overall increase of 5% for energy costs last month. For the year, food prices are up 3.5%, gasoline prices are up 22.5%, and overall energy prices are up 13.2%.

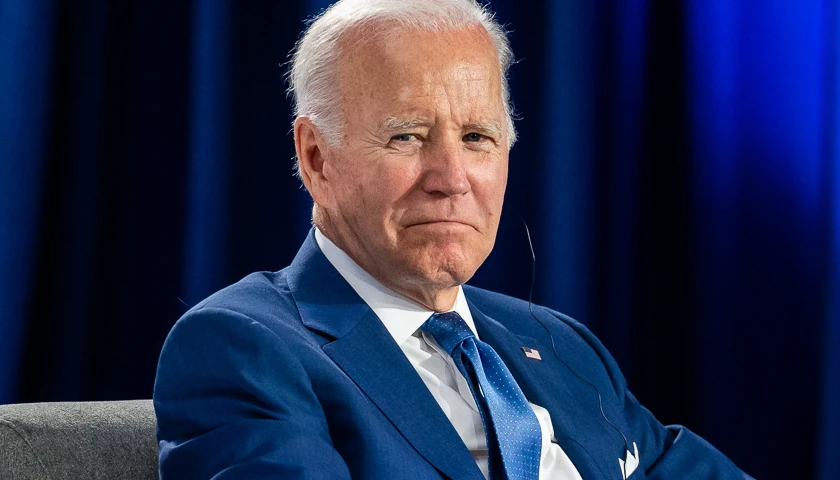

The rise in costs come as many Americans struggle financially during the COVID-19 pandemic and President Joe Biden considers tax increases and more regulations that critics say would slow economic growth.

During a Monday meeting with lawmakers, Biden reportedly expressed openness to adding five cents to the federal gas tax, which would be a 27% increase over the current 18.4 cents. The White House later tried to walk back his comments. Transportation Secretary Pete Buttigieg has also given mixed answers when asked about raising the federal gas tax.

The increase in energy prices, particularly gasoline, leads to an overall spike in the price of consumer goods. When drivers spend more on gasoline to transport goods to market, that cost is passed on to consumers.

“When energy prices rise, the poor and middle class suffer the most,” said Daniel Turner, founder of Power the Future, an advocacy group for energy workers. “Families still have to drive their kids to school, they still have to go to work and to get their COVID vaccines, but they have to pay more to do so. Those unaffected are the rich and the connected, those politicians who get their bills paid by PACs and taxpayers. The very people the left claims to help, the poor, the middle class, rural Americans, they are the ones hurt the most by their policies.“

The BLS data comes after new unemployment claims spiked unexpectedly for the week ending April 3.

Republican U.S. Sen. Rick Scott, R-Fla., blasted the Biden administration Tuesday for not using the federal reserve to lower inflation. An increase in federal reserve interest rates can be used by as a tool to lower inflation, which is a major component in increased prices.

Fed Chair Jerome Powell told “60 Minutes” Sunday that the U.S. economy is at an “inflection point” and that interest rates would likely not be raised this year.

“President Biden and Chair Powell need to wake up,” Scott said. “When you grow up poor, as I did, you know how much it means to a family when prices go up. Today’s CPI data is clear – inflation is on the rise. Yet Biden and Powell remain in la-la land, ignoring the fact that prices of every day goods, like groceries and essential business supplies, are rising and making it harder for folks to make ends meet.

“Americans can’t afford for this to be ignored any longer,” he added. “It’s time for Biden and Powell to return to reality and lay out a clear plan to address rising inflation and protect American families.”

Scott’s home state of Florida is one of many that could experience an increase in utility bills if Biden’s infrastructure bill becomes law.

Americans for Tax Reform (ATR) reports that after the Tax Cuts and Jobs Act lowered the corporate tax rate in 2017, energy companies around the country lowered their energy costs. If Biden’s proposed corporate tax increases tied to the infrastructure bill are passed, that trend could be reversed, ATR contends.

“Customers bear the cost of corporate income taxes imposed on utility companies,” ATR said in a statement. “Corporate income tax cuts drive utility rates down, corporate income tax hikes drive utility rates up.”

Nicolas Loris, an economic expert at the Heritage Foundation, points out that an increase in crude oil demand has led to a steady increase in gas prices for months. He said the high prices today cannot be pinned on the Biden administration, but the administration’s new regulatory and tax policy decisions have the power to make the problem much worse.

Biden has cracked down on oil and gas with measures such as restricting fracking and placing moratoriums on new drilling permits on federal lands. The continued rise of inflation coupled with tax and regulatory measures that raise energy costs could be devastating for states, Turner and others said.

“Raising the cost of energy raises the cost of everything: food, utilities, transportation, manufacturing,” Turner said. “Rising energy costs make life more expensive and more difficult. For four years we saw energy prices plummet and the supply greatly increase. Reversing this trend does nothing for the environment or to combat climate change. It’s political posturing that punishes Americans for living.”

Last month, Deputy Director of the National Economic Council Bharat Ramamurti appeared at a White House news briefing and pushed back against concerns that the large stimulus bills are contributing to inflation.

“You know, our belief has been, from the beginning, that the risk of doing too little to help American families outweighed the risk of doing too much,” Ramamurti said. “That said, we will always be carefully monitoring inflation, and we will continue to do so going forward.”

– – –

Casey Harper is a Senior Reporter for the Washington, D.C. Bureau. He previously worked for The Daily Caller, The Hill, and Sinclair Broadcast Group. A graduate of Hillsdale College, Casey’s work has also appeared in Fox News, Fox Business, and USA Today.

Thank you, Mr. Biden.